Step 1: Make sure your Social Insurance Number (SIN) is up to date on Mosaic

Your Social Insurance Number (SIN) is needed by the Canada Revenue Agency (CRA) for your T2202 or T4A tax forms. Go to Mosaic > Tasks tile or check your personal information to make sure yours is correct.

Don’t know your SIN?

You can request to apply for a SIN at any Service Canada centre. Application forms and instructions are available on Canada.ca. After receiving a SIN you have 15 days to provide it to us for tax information.

Step 2: View your tax forms on Mosaic

- Log in to Mosaic using your MAC ID and password.

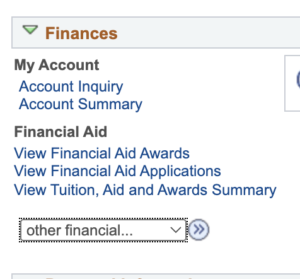

- Go to “Student Center.”

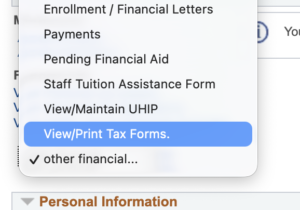

- Open the “Other Financial” drop‑down under “Finance,” select “View/Print Tax Forms,” and then select the blue circular button with two arrows (labeled “Go”)

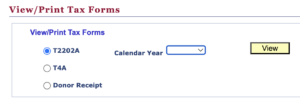

- Select the “Tax form” and “Calendar Year” you desire, and hit “View.”

T2202 FAQs

How is the amount determined?

As directed by the Canada Revenue Agency, beginning with the 2020 taxation year, the amount is determined by the tuition fees paid for terms in the calendar year (not academic year). It is not based on when you paid the institution. So, even if you paid for your winter term several months in advance, it will show up on the certificate for the calendar year associated with that term.

Prior to the 2020 taxation year, the amount was determined by the fees assessed to the student for terms in the calendar year. Any retroactive amendments required to these certificates will continue to follow these guidelines.

The amount also includes fees for eligible co-op placements and eligible ancillary (supplementary) fees. Those eligible ancillary fees include:

- Student Services

- Admin Services

- Athletics & Rec Building

- Student Athletics

- Commerce Services

- Student Health Services

- Educational Trading Centre

- Business Employment Services

- All Co-op Education Fees

- Examination re-read fees

- Application fees paid to McMaster, provided there was subsequent enrolment

In addition, if any pandemic-related credits associated with T2202-eligible fees were applied to the student’s account for terms in the 2020 calendar year, those credits will offset (reduce) the amount on the certificate.

How are the months determined?

In most cases, months are counted based on the class start and end dates. There are also minimum duration requirements: the course must run for a minimum of three consecutive weeks and must require instruction or work in the course of at least ten hours per week throughout the duration.

How do you determine full-time vs part-time months?

For undergraduate students, this is determined by your actual load taken in the term, regardless of your academic designation as either a full- or part-time student. In fall and winter terms, full-time load is considered to be 9 units; for the spring term it is 6 units. For non-undergraduate programs, your approved academic load for your program is used to determine whether you receive full- or part-time months of study credit.

Why do I have months of credit with no tuition?

It’s possible that the official class start or end dates for a course you took fell outside the dates of the term. You would still get credit for those months even though they are outside the term. There would not be any fee associated with those outlying months, though.

Why do I have tuition with no months of credit?

It’s possible that the course you took did not meet the minimum duration requirements, or that the course was ineligible for T2202 consideration in accordance with CRA guidelines.

Why don’t I have tuition or months for the courses I took?

Professional Development programs offered by McMaster Continuing Education are not T2202 eligible.

I am an inbound exchange student – what should I see?

As an inbound exchange student, you would have paid your fees to your home institution. Therefore you will only see months of study credit for those months in which you attended McMaster.

I am an outbound exchange student – what should I see?

As an outbound exchange student, you would have paid your fees to McMaster. Since you did not physically attend McMaster, we cannot record months of study credit. Therefore, you will only see tuition amounts for what you paid to McMaster. The institution which you attended during your exchange can provide information on your attendance there.

Are my residence payments eligible?

According to Canada Revenue Agency guidelines, they are not eligible.

What if my employer paid some/all of my tuition?

Do not claim the amount paid by your employer. Similarly, your employer can claim only the portion they paid.

What address is used on my T2202?

Your T2202 was generated using the address we have in Mosaic which is designated as your home address. This may be different from your mailing address. If your home address is no longer active, we suggest that you go into Mosaic and change it so that nothing else picks up that incorrect address in the future.

Your address is not a critical piece of information for filing and does not affect the your return, so don’t worry if you have an incorrect address listed on your forms. The most important part of your tax forms is your SIN, needed by the Canada Revenue Agency (CRA).

Why don’t I have a T2202 for a particular year?

If you are an undergraduate Nursing student from Conestoga College or Mohawk College, they are your home institution and are responsible for providing your T2202.

How far back may I obtain my T2202?

McMaster has electronic versions of T2202s (formerly known as T2202A) going back to the 2008 taxation / calendar year.

Why is my 2017 spring term split into two?

For taxation year 2017, the Canada Revenue Agency (CRA) required institutions to split amounts for any term that straddled July 1, due to legislative changes in Saskatchewan. The tuition amounts are pro-rated based on the month counts.

Why isn’t my SIN appearing on my tax forms?

Your SIN will not appear on your T4A or T2202A if it was not previously updated in Mosaic.

To update your SIN, click the “Update SIN (Student)” tile. You can also navigate to your Student Centre and click Demographic Data under Personal Information. Enter your SIN, without spaces, and click Save.

Please note: Your SIN is required by the Canada Revenue Agency (CRA). If you claim an education deduction and your T2202 does not include your SIN the CRA may deny your deduction.

T4A FAQs

Why can’t I see my T4A?

Please make sure that your browser does not block pop-ups.

Why don’t I have a T4A for a particular year?

You will only be issued a T4A if you received eligible aid or scholarships during that calendar year.

Does this include my TA pay?

If you were paid for any TA or research work, then a T4A would be issued by Human Resources for those payments and would be available through the Employee Self-Service section of Mosaic.

Why is my Social Insurance Number (SIN) required?

The Canada Revenue Agency (CRA) requires the inclusion of this information on T4A certificates as these certificates represent a source of income to the student. While international students will not have a SIN, all domestic students should have one, and it must be registered in Mosaic. The CRA requires that McMaster prove due diligence in obtaining SINs, and we have been reaching out to those students since December 2020. It is important to note that McMaster will still report all T4As to the CRA whether or not they include a SIN.

For students who have been issued a brand new SIN and who show proof of new issue, McMaster will issue an amended T4A which includes the new SIN. Amendments for SIN will not be issued otherwise.

Information on how to obtain a Social Insurance Number can be found through Service Canada.

How is the amount determined?

All scholarships, bursaries, and other aid which has been designated as T4A-eligible is reported if it was issued to the student during the calendar year (not academic year). Any adjustments to said aid which is made in the subsequent calendar year will be reported on that year’s T4A.

How far back may I obtain my T4A?

McMaster is required to retain 10 fiscal years’ worth of forms. Electronic copies of T4As are available for the 2015 taxation year and onward in Mosaic.

Are research participant payments taxable?

Yes. Payments to research participants identified as students will be processed through student accounts and sent via Interac e-transfer to the student’s McMaster email address. A T4A will be issued each February for all participant payments made to students in the previous tax year.